Risk Management can be defined as applied science, focusing specifically on mathematics and statistics, economics and finance to solve financial problems involving uncertainty in value. Risk Management master’s programme will equip you with the all-round knowledge and skills necessary to succeed in the constantly evolving fields of insurance, risk and risk management. Risk Management knowledge will use mathematical skills and numeracy skills to identify, analyze, and solve problems in business and social. Those who want to follow this program must have a strong interest and ability in math.

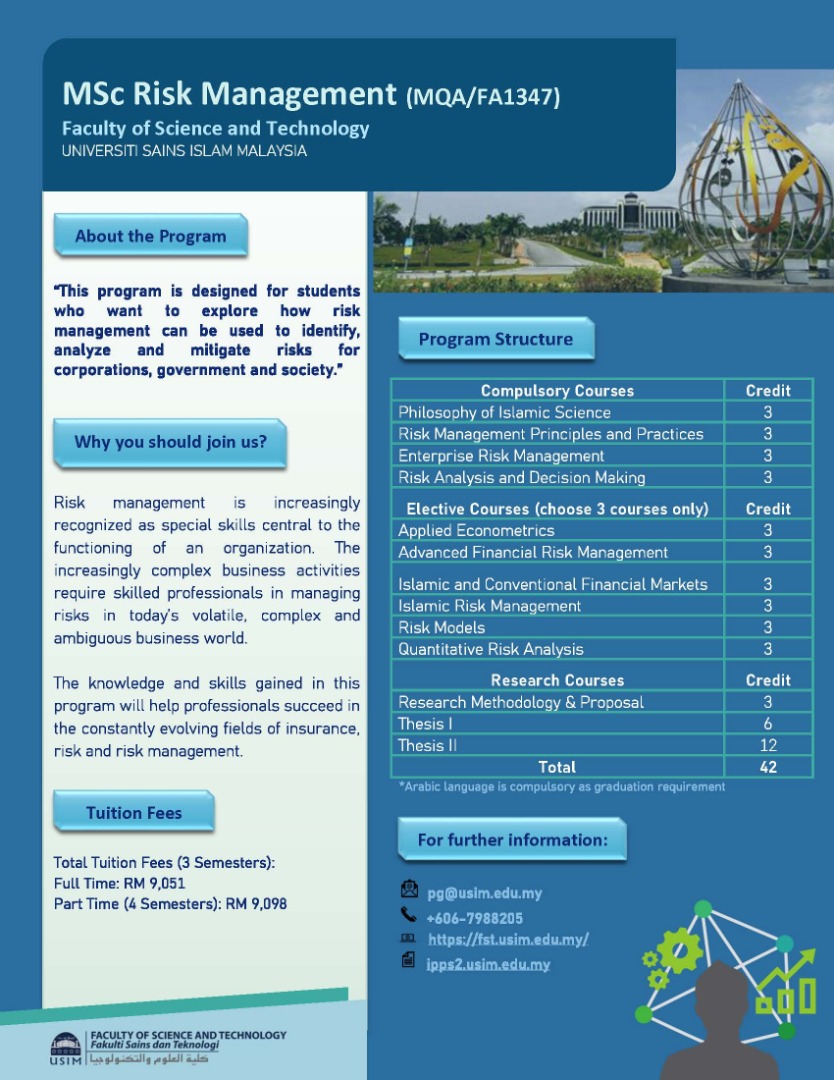

The Master of Science (Risk Management) program was first offered in Semester I, Academic Session 2012/2013. The program is offered in mixed mode structure, and the total number of credit hours for this program is 42 credit hours.

The objectives of the programme are to produce:

- Risk managers who can apply and adapt knowledge and practical skills in the field of risk management to produce quality research while providing the best services to relevant sectors.

- Risk managers who are able to lead, work in a team in solving problems, provide new ideas and subsequently convey and communicate information effectively.

- Risk managers who constantly strive to improve their knowledge and capabilities by leveraging digital technology to solve problems in relevant sectors.

- Risk managers who practice ethical and professional values in providing services to relevant sectors.

At the end of the programme, students will be able to:

- Describe advanced knowledge in the field of risk management. (Knowledge)

- Adapt risk management knowledge and skills, and practice critical thinking in solving problems through data analysis and processing techniques.(Cognitive Skills)

- Develop practical research skills in conducting experiments, analysing and interpreting data for research in the field of risk management. (Practical Skills)

- Demonstrate interactive communication skills and social accountability as an educated person and able to work in a team. (Interpersonal Skills)

- Communicate orally and convey information effectively to all levels of society. (Communication Skills)

- Adapt digital technology in identifying, analysing and processing data to solve problems in the field of risk management.(Digital Skills)

- Apply basic and advanced knowledge of mathematics and statistics to solve problems related to risk management using appropriate techniques. (Numerical Skills)

- Demonstrate leadership characteristics, autonomy and responsible decision making in a team work environment. (Leadership, Autonomy and Responsibility)

- Demonstrate confidence, self -control, appropriate social skills and commitment to continuous learning. (Personal Skills, Entrepreneurial Skills)

- Demonstrate an understanding of the fundamentals of commercialization, ethics and legislation, as well as social issues related to the field of risk management. (Ethics and Professionalism)

Graduate in this field may enter the takaful and insurance industry, consultancy, funds, securities, stocks, finance, banking, marketing, reinsurance, investment, capitalization, health, transportation (land, sea and air), mining, oil, business and multinational companies . They can also be entrepreneurs, franchise holders or work in the public sector (such as in central banks, inland revenue, financial groups, public trustees, or education).