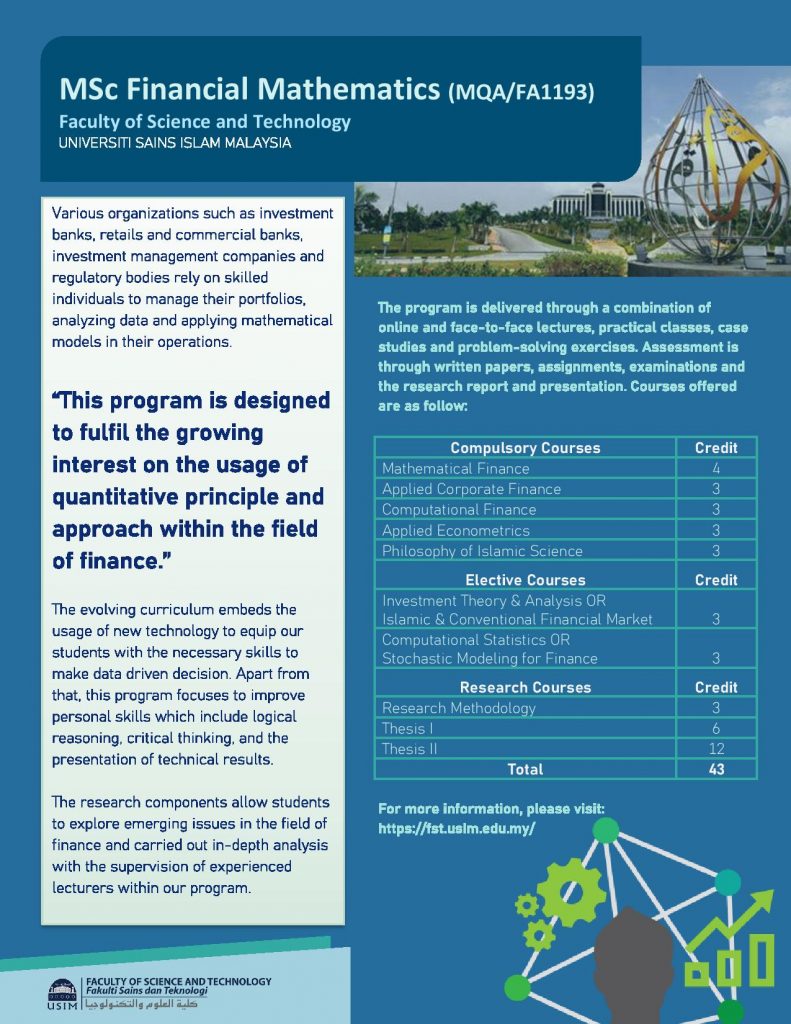

The Master of Science (Financial Mathematics) program was first offered in Semester I, Academic Session 2012/2013. The program is offered in mixed mode structure, and the total number of credit hours for this program is 43 credit hours whereby 48% or more of the total number of credits is dedicated for research.

The programme educational objectives (PEOs) are to produce:

PEO 1 : Financial mathematicians who use advanced, quantitative, and practical knowledge to solve problems and produce quality research.

PEO 2 : Financial mathematicians who can lead, make meaningful contributions in the team and practice effective communication among team members and other relevant parties

PEO 3 : Financial mathematicians who are competitive by leveraging current digital technology developments in providing services and able to create new opportunities.

PEO 4 : Financial mathematicians who are independent, ethical and practice good governance in providing professional services.

At the end of the programme, students will be able to:

- Describe basic and advanced knowledge in the field of financial mathematics. (Knowledge)

- Adapt advanced knowledge to think critically in solving problems. (Cognitive Skills)

- Develop practical and technical skills to analyze data in the field of financial mathematics. (Practical Skills)

- Demonstrate interactive communication skills and social accountability as an educated person and able to work in a team. (Interpersonal Skills)

- Communicate orally and convey information effectively to all levels of society. (Communication Skills)

- Adapt digital technology to meet current needs in the field of financial mathematics. (Digital Skills)

- Apply quantitative information accurately to solve problems. (Numeracy Skills)

- Demonstrate meaningful contribution as a leader or team member in achieving objectives. (Leadership, Autonomy and Responsibility)

- Demonstrate high self -motivation in improving skills in the field of financial mathematics. (Personal Skills)

- Demonstrate entrepreneurial characteristics that are able to create new opportunities. (Entrepreneurial Skills)

- Demonstrate ethics and good governance professionally. (Ethics and Professionalism)

The career paths for financial mathematics graduates cover a large area of the financial services industry, which includes job opportunities in commercial banks, accounting and financial consulting firms, investment firms, insurance companies, investment banks, brokerage firms, public institutions, international organisations as well as technology vendors and software that provides products and services to the financial industry. Due to the high mathematical ability required in the contemporary financial industry, there is always a room for a well-trained financial mathematicians, which makes the graduates from this field are much in demand by the industry.

A feel for the work of financial mathematicians can be gained from the following websites: