Actuarial Science and Risk Management can be defined as applied science, focusing specifically on mathematics and statistics, economics and finance to solve financial problems involving uncertainty in value. Actuarial science knowledge will use mathematical skills and numeracy skills to identify, analyze, and solve problems in business and social. Those who want to follow this program must have a strong interest and ability in math.

Therefore, the Actuarial Science and Risk Management programme intends to produce actuarial practitioners and risk managers who will:

- PEO1: Can combine knowledge (LO1) and practical skills (LO2) in Actuarial Science and Risk Management to serve the nation and society(LO1, LO2);

- PEO2: Able to lead (LO5), teamwork (LO5), social skills (LO3), effective communication skills (LO5) and knowledge-solving problems in critical and scientific thinking (LO6) (LO3, LO5, LO6);

- PEO3: Always trying to improve lifelong knowledge (LO7), have good management skills (LO8) and ability to identify entrepreneurial opportunities (LO8) in the Actuarial Science, Risk Management and related industries (LO7, LO8);

- PEO4: Practice ethical and professional values in a career (LO4).

At the end of the program, students are able to:

- PO1: Seek and use core and advanced knowledge in Actuarial Science and Risk Management (LO1);

- PO2: Have practical skills in a particular field, as well as analyzing and interpreting data for research use in Actuarial Science and Risk Management (LO2);

- PO3: Have social accountability as a learned and responsible person (LO3);

- PO4: Committed to upholding ethical and professional responsibilities and integrating with the knowledge of Naqli and Aqli (LO4);

- PO5: Communicate effectively and demonstrate leadership skills in team work environments (LO5).

- PO6: Think critically in identifying, analyzing and solving problems using appropriate techniques (LO6);

- PO7: Obtain and disseminate scientific information related to the field of Actuarial Science and Risk Management as well as demonstrating a desire for lifelong learning (LO7);

- PO8: Skills in entrepreneurship and management and apply it (LO8);

Students are encouraged to take professional examinations, whether organized by the Actuarial Society in the USA, Australia or Canada, or the Actuarial Institute in England, or the Faculty of Actuaries in Scotland. Those with professional qualifications will be more likely to work and have a better chance of earning a higher salary.

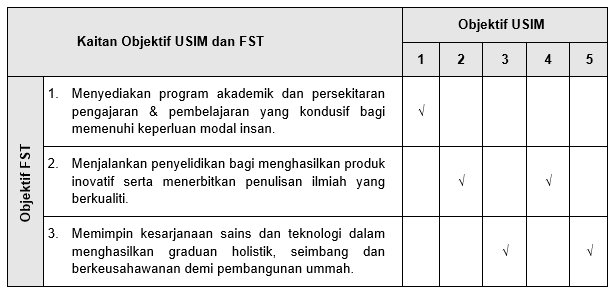

Jadual Kaitan Objektif Universiti (USIM) dan Fakulti Sains Teknologi (FST)

Jadual Kaitan Objektif FST dan Program Sarjana Muda Sains Dengan Kepujian (Sains Aktuari dan Pengurusan Risiko)

Objektif USIM

- Memartabatkan pendidikan Islam serta membawanya ke dalam arus perdana pendidikan negara.

- Membina kesepaduan antara teori dan amali dalam diri setiap siswazah yang dikeluarkan.

- Melahirkan ilmuan Islam yang berpendidikan sepadu, mampu memimpin masyarakat majmuk serta mempunyai potensi yang tinggi menerajui pembangunan negara.

- Meneroka dan mengembalikan tradisi keilmuan Islam yang unggul bersesuaian dengan persekitaran dan teknologi terkini.

- Membekalkan modal insan yang kukuh dengan penghayatan nilai Islam yang mampu berinteraksi dan berkomunikasi dengan berkesan dalam masyarakat.

Objektif Fakulti (FST)

- Menyediakan program akademik dan persekitaran pengajaran & pembelajaran yang kondusif bagi memenuhi keperluan modal insan.

- Menjalankan penyelidikan bagi menghasilkan produk inovatif serta menerbitkan penulisan ilmiah yang berkualiti.

- Memimpin kesarjanaan sains dan teknologi dalam menghasilkan graduan holistik, seimbang dan berkeusahawanan demi pembangunan ummah.

Graduate in this field may enter the takaful and insurance industry, consultancy, funds, securities, stocks, finance, banking, marketing, reinsurance, investment, capitalization, health, transportation (land, sea and air), mining, oil, business and multinational companies . They can also be entrepreneurs, franchise holders or work in the public sector (such as in central banks, inland revenue, financial groups, public trustees, or education).